Everyday my to-do list starts off like this:

5:30am: Get up for gym

9am: Work

5:30pm: Skip home from work

6pm: Make something for dinner that requires more than 2 ingredients

7pm-: Spend the rest of the evenings organizing house

In reality, it turns in to something like this:

5:30am: Get mad at alarm for disturbing sleep and reset to 7:30am

7:30am: Wake up, get mad at self for skipping the gym

9am: Drag self to work with my best friend caffeine

9:30am-2pm: Avoid eating tasty treats that co-workers bring in

2:30pm: Cave and eat the treats anyways

5:30pm: Skip home from work

6pm: Make some sort of plain protein with sides of simple veggie dishes (on a side note, I'm starting to get handy with the grill!)

7pm: Plop on couch, put off organizing until the weekend

Needless to say there is so much to be done that I can't get motivated to start small. Combine that with a long work day and just pure laziness, nothing has seemed to be getting done. I think a stay-cation is in order? BUT this past weekend, a few of my boyfriend's friends helped put up the kitchen shelves/décor I've been dying to put into action (pictures soon!). The kitchen, aka my favorite part of any house, is finally coming together. Though I can't actually fit an IKEA trip until August, I've finally put together a project to do list. One room at a time of course - sometimes plopping on the couch is a must.

Now if only I could get motivated for that 5:30am wake-up call...

Wednesday, July 16, 2014

Wednesday, June 11, 2014

DIY Gift for Mom

Just before Mother's Day I was on Pinterest looking for a thoughtful but low cost gift for mom. I love my mamma and she deserves all the wonders of the world for Mother's Day but in reality, I was closing on a house in under 3 weeks so 16 cent tiles from Lowes sounded just peachy! I found the idea for picture coasters here (step by step directions) and they were perfect and SO easy to make! No really, I made them while catching up on an episode of Grey's Anatomy. I picked out my favorite picture of each of my nieces and nephews and she loved them!

I saw them set up on my mom's nightstands when I was home last week and I noticed the one of David was missing (the cutie in the bowtie). Fearing it had already been broken by the toddlers in the house I asked where it went. My mom said, "Oh, David keeps walking off with himself!"

Not only a good gift for mom, but amusing for kids. Enjoy.

Tuesday, June 3, 2014

MIA Excuses

Oops I haven’t posted since March… BUT I have a few very good excuses!

Here is what I’ve been up to:

1.

I finished up my first semester of grad school

and just like everyone says, it was hard work!

Though I was only taking one class, combined with 2 jobs and an already

crazy schedule, it was tough to fit in all the necessary hours of work. I struggled through the last few weeks but

made it out with an A! The homework wasn’t

too difficult to manage and neither were the presentations every student gave. However, the toughest part of the course was the term

paper on top of those assignments– at least 20 pages on ACCOUNTING FRAUD.

Talk about a snoozer. In the end,

the topic ended up being interesting but I did have to peel off my eyelids

from my eyeballs a few times in order to do the necessary amounts of research and

analysis. Also I'm pretty sure I killed a few dozen trees in the process. But seriously, go ahead and

quiz me on the JPMorgan Accounting Fraud case from 2012 – I’m a pro. Though I’m a total math geek and actually enjoyed

taking accounting, I’m excited to move on to other courses in the fall.

2. My weekends filled up so quickly between Easter, running the Monument 10k in Richmond and the Race for Hope 5k in DC, road tripping to my alma matter, and a surprise visit from my brother from Hawaii!

2. My weekends filled up so quickly between Easter, running the Monument 10k in Richmond and the Race for Hope 5k in DC, road tripping to my alma matter, and a surprise visit from my brother from Hawaii!

3.

Tis the season of graduations! Including my boyfriend who just graduated

from college! Kudos to him. He started his first big boy job this week

and I couldn’t be more proud or excited for him! The picture on the right is the least blurry picture from his ceremony (Tim is waving!) and the picture you see on the left is in fact a blown up picture of his head held up for all of graduation to see, compliments of a good friend.

4.

Drum roll please...I bought a house! No, you didn’t read that incorrectly. This 23-year-old is a homeowner! I’ve been hesitant to share because honestly I’ve

been waiting for someone to pinch me and it have all been a dream. I go back and forth between being so excited

out of my skull and wanting to vomit a little.

Between everything listed above, throw in daily document scavenger hunts

followed by hours of scanning and sending, endless emails with my lender and

program coordinators, running different scenarios through Excel to make sure I

wasn’t completely ruining my life (spreadsheet dork here), working

a ton of hours to make those closing costs not result in a negative account

balance, packing boxes (though let's face it, the move out of mom's is probably the easiest move you'll ever make), and of course convincing myself I was doing the right thing. Honestly I’m surprised this all happened

without at least one panic attack. But

it has indeed and I’m in the middle of unpacking boxes as we speak. To say I’ve been a busy bee is an understatement but

everything was worth it! I can’t wait to

share all the deets, so stay tuned my friends.

...I promise I won’t wait 3 months again.

...I promise I won’t wait 3 months again.

Anyone have any first time homeowner tips? I’d love to hear!

Monday, March 17, 2014

Going Green

Today's long overdue post is on my latest attempt to get nutrients into my body. Yes, I am jumping on the green smoothie wagon. Here's why.

Since last October, I have been sick for weeks at a time, with maybe 2 weeks of relief in-between. Turns out I am recovering from mono and oh-what-fun-it-has-been. Don’t get me wrong, I’m nowhere near my death bed, I just get these little colds/viruses that I can’t seem to shake. But now I drink GREEN SMOOTHIES, and I haven’t picked up anything in weeks! I started in early February, and haven’t been sick since. Inspired by a friend who found this site, I make a green smoothie almost every day and I feel almost 100% better! I’m knocking on wood as we speak, but I think my mono days are over. But seriously, now what excuse will I use when I don't want to go out on a Friday night??

Since last October, I have been sick for weeks at a time, with maybe 2 weeks of relief in-between. Turns out I am recovering from mono and oh-what-fun-it-has-been. Don’t get me wrong, I’m nowhere near my death bed, I just get these little colds/viruses that I can’t seem to shake. But now I drink GREEN SMOOTHIES, and I haven’t picked up anything in weeks! I started in early February, and haven’t been sick since. Inspired by a friend who found this site, I make a green smoothie almost every day and I feel almost 100% better! I’m knocking on wood as we speak, but I think my mono days are over. But seriously, now what excuse will I use when I don't want to go out on a Friday night??

This was a little difficult to work into my Dave Ramsey envelope system right away, but I’ve managed to stay within my

parameters by buying fresh vegetables and frozen

fruit. The main things in my shopping

cart are spinach, cilantro, and kale as well as bananas, mango, apples, oranges, and pineapple. Bananas are basically free and the frozen pineapple

and mango bags from Costco and Wegmans aren’t too devastating to my groceries

envelope and go a long way. Sometimes I splurge and go for the avocado and giant box of kiwis.

The best part is, these nutrient filled smoothies are

delicious! By sticking to the appropriate veggie/fruit ratio, I haven’t had a smoothie I didn’t like yet (and I'm saying this as a kale hater). And for all you

parents out there, I even got my picky-eater-4-year-old-niece to drink a whole

8 ounces of a smoothie made with primarily spinach! She had a sip, and then asked for more! Next

challenge, my three year old nephew who vomits when he eats celery!

On a side note, what a coincidence that I happen to be writing about this on St. Patty's Day. Does the fact that I drank a green smoothie today make up for me forgetting to wear green....I had to sweep 10 inches of snow off my car this morning, can you blame me?! (hash tag bitter East Coaster)

On a side note, what a coincidence that I happen to be writing about this on St. Patty's Day. Does the fact that I drank a green smoothie today make up for me forgetting to wear green....I had to sweep 10 inches of snow off my car this morning, can you blame me?! (hash tag bitter East Coaster)

Thursday, January 30, 2014

Little Things, Big Impact

Tis the season of New Years Resolutions. In honor of January's end, I've made another list of goals.

Tis the season of New Years Resolutions. In honor of January's end, I've made another list of goals. I was reminded earlier this month how beautiful life is. My baby nephew was born January 16th and is named Alan, after my father. Baby Alan was born exactly one year after we buried my dad. Pretty incredible, huh?

I think I've been so anxious waiting for this new year that I've lost track of those little things that make life truly breathtaking if you take a step back and let them. So here are a few I'd like to focus on this year, and every year for that matter.

I'm going to stick this list in my textbook, to remind myself everyday of those little things that have a huge impact.

Wednesday, January 29, 2014

How I got ready for grad school

So I may or may not have used grad school as an excuse to buy a bunch of fun supplies...but is that really so wrong? I did a lot of research (go ahead, call me a dork) and finally settled on the following items. But first, here is a little on why I chose Marymount University.

So I may or may not have used grad school as an excuse to buy a bunch of fun supplies...but is that really so wrong? I did a lot of research (go ahead, call me a dork) and finally settled on the following items. But first, here is a little on why I chose Marymount University.Why I chose Marymount: I went to a grad school fair at George Mason last winter. I was a little discouraged because most of the schools I wanted to apply to would not accept applicants with less than 2-5 years of post-grad experience. I had literally only been out of college for 2 months. Finally I landed at Marymount's table and was relieved to hear they accepted applicants right out of college. My sister spent 6 years at Marymount getting her Doctorate in Physical Therapy and I had always loved visiting! Marymount has a Reston campus, which conveniently is only 15 minutes away from my house and job. They have small class sizes which I think is perfect for a graduate program. Seriously, I am one of 5 students in my class. Big fish in a small pond theory at it's finest.

Planner: This is probably what I spent the most time picking out. I tried going electronic, I really did. I'm sorry to disappoint you generation y, but I just can't leave the paper planner. Since I am only taking one class at a time, it didn't have to be crazy big. I mulled over the Day Designer and the Simplified Planner but I knew I wouldn't utilize all the space since we primarily use Outlook at work. One of my friends has a May Designs planner and I fell in love! It has just enough space to keep track of my one class and shifts at my part-time job, but small enough to throw in my purse. The best part is that it's customizable! Who doesn't love customizing the way they organize?!

Planner: This is probably what I spent the most time picking out. I tried going electronic, I really did. I'm sorry to disappoint you generation y, but I just can't leave the paper planner. Since I am only taking one class at a time, it didn't have to be crazy big. I mulled over the Day Designer and the Simplified Planner but I knew I wouldn't utilize all the space since we primarily use Outlook at work. One of my friends has a May Designs planner and I fell in love! It has just enough space to keep track of my one class and shifts at my part-time job, but small enough to throw in my purse. The best part is that it's customizable! Who doesn't love customizing the way they organize?!Laptop: So whether or not I absolutely had to make this purchase was questionable. I have a laptop that I got from Freshman year of college but it has since slowed down and has little battery life. Still manageable however. Buying a new laptop was in the back of my mind though and I was even considering going tablet. Black Friday pushed me over the edge. I found this baby for a great deal and snatched up one of the last ones. It is a touch screen, has the latest version of Windows (I'm still a little bitter about purchasing my laptop in 2008 just before Windows 7 was released), and it is nice and slim! I heard once you go touchscreen you don't go back and I'd have to say that is probably true. I still store all my music on my old laptop and I find myself trying to touch the screen and getting confused. My new laptop is small enough to fit in my bag but big enough to type comfortably for long periods of time (hellO research paper). I had never had a Lenovo laptop before, but so far, so good. My only complaint is that the battery doesn't last as long as I'd like it to but it will still get me through my 2 hour and 45 minute class.

Laptop Sleeve: I decided to go for the sleeve as opposed to case this time around. Something snug to protect my laptop from the wear and tear of my purse. I seriously spent hours on Etsy trying to decide which was my favorite. I finally picked this one from Bertie's Closet, though I almost picked this one. I ended up going with the darker of the two since this will spend a good amount of time in a bag. It arrived at my house exactly one week from the day I ordered it and it was love at first sight. It fits perfectly around my 11.6" laptop.

Tote: Conveniently enough my sister-in-law is a Thirty-One Rep and my sister and I hosted a party a couple weeks ago. I order the Cindy Tote in the Black Tweed print for a stylish but professional bag to haul my things to class. It is not too big to use as a purse but still fits everything I need for class (binder, textbook, laptop, wallet, etc.). I am a huge fan of my Jansport backpack but figured it was time to select something a little more sophisticated. I chose not to get it embroidered because I go by a variety of names depending on where I am and where I'm working and let's be real, hopefully my last name will change within a few years...(subtle? probably not.).

Tote: Conveniently enough my sister-in-law is a Thirty-One Rep and my sister and I hosted a party a couple weeks ago. I order the Cindy Tote in the Black Tweed print for a stylish but professional bag to haul my things to class. It is not too big to use as a purse but still fits everything I need for class (binder, textbook, laptop, wallet, etc.). I am a huge fan of my Jansport backpack but figured it was time to select something a little more sophisticated. I chose not to get it embroidered because I go by a variety of names depending on where I am and where I'm working and let's be real, hopefully my last name will change within a few years...(subtle? probably not.). Don't worry, I ordered my textbook before all of the above and was plenty prepared for the academic aspects of grad school.

So that's my fun school stuff! I have a couple more things on my wish list including a tablet and a nice desk. But I have tuition to pay for instead of a tablet and I'll use the dining room and kitchen tables as desks until I find more space or get my own place. I'd even like to have a large desktop computer eventually in addition to my laptop. Less squinting and I'm also a huge fan of the mouse. I'm using my mom's printer for now but eventually I'll need to replace the one that I had in college.

I spent a lot of time on Pinterest and other blogs learning about how others got ready for grad school. I'd love to hear your thoughts and how you prepared for your first class! Did I miss anything good?

Monday, January 27, 2014

Study Snack: Apple Cinnamon Coffee Cake Muffins

Stop what you are doing and make these, whether you need a study snack or something sweet to go with your coffee. These were a great late night sweet treat (I may or may not have eaten 4) and they were even better with my coffee the next morning after they had sat all night (I pounded another three...whoops).

Stop what you are doing and make these, whether you need a study snack or something sweet to go with your coffee. These were a great late night sweet treat (I may or may not have eaten 4) and they were even better with my coffee the next morning after they had sat all night (I pounded another three...whoops). I was searching for a recipe on Pinterest involving apples because that was basically the only baking material we had around the house last week. I found this recipe from Our Best Bites and tweaked it a bit. Halfway through combining the ingredients, I realized that I didn't have any sour cream (...oops) so I substituted 1 cup of sour cream with 1 cup of Greek yogurt and 1 teaspoon of baking soda. Fewer calories and no trip to the store was needed. Win win.

Apple Cinnamon Coffee Cake Muffins, recipe originally by Our Best Bites

Makes: 24 muffins

Prep time: 15 minutes

Cook time: 20 minutes

Total time: 35 minutes

Ingredients:

1 box of yellow cake mix (I used Betty Crocker)

1/2 cup canola oil

2 teaspoons cinnamon

3 eggs

1 cup Greek yogurt (I used plain though I think vanilla would have been delicious!)

1 teaspoon of baking soda

1 teaspoon vanilla

3 medium apples, peel and chopped (I used Fuji only because it was what we had)

1 tablespoon lemon juice

2 tablespoons of flour

Topping:

1/2 cup white sugar

1/4 cup flour

1 teaspoon cinnamon

3 tablespoons butter, softened

Instructions:

Preheat the oven to 350 degrees. Line your muffin pans with liners.

Combine the cake mix, cinnamon, and baking soda in a large mixing bowl. Then add the oil, eggs, Greek yogurt, vanilla, and lemon juice. Mix on low for 30 seconds so that the ingredients blend together, and then high for 3 minutes.

Fold in the peeled and chopped apples. Scoop into the 24 liners.

Whisk together the sugar, flour, and cinnamon for the muffin topping. Then add the butter. Whisk until the mixture becomes crumbly (you may need to break apart some large clumps) and sprinkle that deliciousness onto your unbaked coffee cakes.

Pop those babies into the oven for 20-25 minutes (20 worked best for my oven) until the muffin tops are golden and a toothpick comes out clean.

Let them cool on a wire rack or eat them straight from the muffin pan. Whatever your little heart desires.

These CAN be eaten in bulk without getting a tummy ache. You're welcome.

Thursday, January 16, 2014

If you build it, he will come

This week started with the anniversary of my father's passing and finished with my first day of grad school. I spent a lot of time last week thinking about what I would do on this day. I mulled over sleeping away the entire thing, going to work to distract myself, or making a ton of pastries and watching Harry Potter all day. Finally, I decided to take a day away from planning, organizing, working, and strategizing and really celebrate the good times and some of my favorite memories with my father.

First stop, donuts and coffee. My dad and I would always go to Dunkin Donuts after church on Sundays. As I got older, this turned into Starbucks and was accompanied by my latest paper or a tutor session, but donuts and coffee was always involved. Though he always let me pick, my dad swore by Dunkin Donuts coffee over Starbucks. Clearly, he had never tasted a Gingerbread Latte.

First stop, donuts and coffee. My dad and I would always go to Dunkin Donuts after church on Sundays. As I got older, this turned into Starbucks and was accompanied by my latest paper or a tutor session, but donuts and coffee was always involved. Though he always let me pick, my dad swore by Dunkin Donuts coffee over Starbucks. Clearly, he had never tasted a Gingerbread Latte.

Then I went to Great Falls Park in McLean. My dad loved being in nature. When I say nature, I don't mean the sands and the ocean. I mean the mountains, the woods, and any other place where it is uncommon to find indoor plumbing or electricity. Growing up I was never really a fan. My dad always called me a city girl and made jokes about not being able to go anywhere without my hair dryer or cell phone. But as I've gotten older, I've really started to enjoy being outside and appreciating the natural beauty in the world. Even though it was a little chilly and I may or may not be recovering from mono, I really did feel close to him out there on the rocks and near the water.

Finally, I watched Field of Dreams, one of my dad's favorite movies. Seriously, the man had a shirt that said "If you build it, he will come." Call it a cheesy 80s flick but I think we can all agree there is something magical about baseball and the way it is portrayed in this movie. Whether you lost a parent or not, that last scene makes you tear up and get all warm and fuzzy inside (don't deny it!). I think this movie reminded my dad of his father and that is why he loved it so much. I love to think that they are "having a catch" up in heaven right now.

Finally, I watched Field of Dreams, one of my dad's favorite movies. Seriously, the man had a shirt that said "If you build it, he will come." Call it a cheesy 80s flick but I think we can all agree there is something magical about baseball and the way it is portrayed in this movie. Whether you lost a parent or not, that last scene makes you tear up and get all warm and fuzzy inside (don't deny it!). I think this movie reminded my dad of his father and that is why he loved it so much. I love to think that they are "having a catch" up in heaven right now.

It's not a secret that I was ready to move on from this year, but I am glad I got to spend a day celebrating and appreciating the life my father led. I know I went back to school this week with an angel by my side, like I've had all year.

Then I went to Great Falls Park in McLean. My dad loved being in nature. When I say nature, I don't mean the sands and the ocean. I mean the mountains, the woods, and any other place where it is uncommon to find indoor plumbing or electricity. Growing up I was never really a fan. My dad always called me a city girl and made jokes about not being able to go anywhere without my hair dryer or cell phone. But as I've gotten older, I've really started to enjoy being outside and appreciating the natural beauty in the world. Even though it was a little chilly and I may or may not be recovering from mono, I really did feel close to him out there on the rocks and near the water.

Finally, I watched Field of Dreams, one of my dad's favorite movies. Seriously, the man had a shirt that said "If you build it, he will come." Call it a cheesy 80s flick but I think we can all agree there is something magical about baseball and the way it is portrayed in this movie. Whether you lost a parent or not, that last scene makes you tear up and get all warm and fuzzy inside (don't deny it!). I think this movie reminded my dad of his father and that is why he loved it so much. I love to think that they are "having a catch" up in heaven right now.

Finally, I watched Field of Dreams, one of my dad's favorite movies. Seriously, the man had a shirt that said "If you build it, he will come." Call it a cheesy 80s flick but I think we can all agree there is something magical about baseball and the way it is portrayed in this movie. Whether you lost a parent or not, that last scene makes you tear up and get all warm and fuzzy inside (don't deny it!). I think this movie reminded my dad of his father and that is why he loved it so much. I love to think that they are "having a catch" up in heaven right now.It's not a secret that I was ready to move on from this year, but I am glad I got to spend a day celebrating and appreciating the life my father led. I know I went back to school this week with an angel by my side, like I've had all year.

Sunday, January 12, 2014

New Year, New Systems Part 2: Managing Expenses

If you are like me, you want to know where your money is

going (even though you know it is going to clothes, shoes, and Chipotle). I think the key to that is a good budget and a good system to manage your expenses. So borrowing a little advice from Mr. Dave Ramsey's Guide to Financing, I developed a detailed budget and then placed my budgeted money into his envelope system. Basically Mr. Ramsey

instructs to know where every single dollar is going and to use cash in order to manage this.

Essentially, each category of your budget (food, clothes, etc.) gets a designated envelope with cold hard cash that you take out at the beginning of the month or biweekly, whatever you prefer. You place your budgeted money into its designated envelope. Whenever you purchase something, you take money out of the corresponding envelope. When you run out of dough, you run out. There is no replenishing until next month. So here is what you gotta do to get there:

Step 1 Budget:

I've got multiple spreadsheets going on here. One for an annual budget and one for each month of the year. I’ve got money budgeted from groceries and insurance, to Starbucks and dry cleaning.

After crafting a detailed budget, I placed budgeted money into envelopes (you can find some fun printable envelopes here!) at the beginning of the month. Below are the categories I chose. I picked these because it is where I tend to spend frivolously and unpredictably. But obviously these can be tailored to your own crazy ways.

Essentially, each category of your budget (food, clothes, etc.) gets a designated envelope with cold hard cash that you take out at the beginning of the month or biweekly, whatever you prefer. You place your budgeted money into its designated envelope. Whenever you purchase something, you take money out of the corresponding envelope. When you run out of dough, you run out. There is no replenishing until next month. So here is what you gotta do to get there:

Step 1 Budget:

I've got multiple spreadsheets going on here. One for an annual budget and one for each month of the year. I’ve got money budgeted from groceries and insurance, to Starbucks and dry cleaning.

Annually: Here I’ve got my predictable expenses

spread out across a year. Insurance, car

payment, gas, tuition, taxes, cell phone, etc. This helps me see how much of my

money is going where in a year.

Monthly: A few days before each month, I’ll plan my upcoming expenses. If there is

nothing unpredictable coming up, it will look just like the annual form. But if I know I need new tennis shoes soon, I’ve

got a birthday/holiday coming up, or I’m planning a vacation, I’ll budget for

it that month. I can also see what

percent of my monthly income is going towards each expense. This is helpful and really provides some

perspective. If 50% of your budget is

going towards clothes, something is up.

I also have a column for what I actually spent, and a column for the

difference. That way when the month is

over, I can plug in what I’ve actually spent and know if I need to adjust the

amount budgeted for the next month.

Step 2 Envelopes:After crafting a detailed budget, I placed budgeted money into envelopes (you can find some fun printable envelopes here!) at the beginning of the month. Below are the categories I chose. I picked these because it is where I tend to spend frivolously and unpredictably. But obviously these can be tailored to your own crazy ways.

1. Groceries: Straight forward. I tend to stop at Wegmans between the gym and work in the morning to pick out a “treat” for my hard workout or to grab a lunch if I forgot one. This needs to be controlled. Hopefully I'll end up eating less muffins as well.

2. Clothing/Shoes: Some months are more than others if I know I need a holiday outfit or my tennis shoes are wearing thin.

3. Leisure Activities: Anything in the entertainment department goes here

4. Dining out/Dranks: Got to budget for hot dates, time with my roomies and friends, and of course, happy hour!

5. Fast food: I try to avoid eating fast food, but this is for those times where I’m starving and it is not possible to get something from home.

6. Starbucks/Coffee: The amount I spend on coffee is ABSURD. Some days you are just not in the mood for what your K-cup selection has to offer, ya know? But this is just not necessary so I've capped myself off with this envelope.

7. Gift Fund: Odds are, there is a birthday/anniversary/holiday sometime in the month

8. Necessities: Toiletries, deodorant, etc. Things you can’t avoid replenishing every month. We can’t have you smelling at work because you didn’t budget for soap.

You may have noticed things like gas and co-pays weren’t on this list. I decided that gas is something I don’t spend a lot on (thank you 10 minute commute!) and when I need to go somewhere it is pretty much unavoidable. I wouldn’t keep myself from going to the doctor or dentist if I needed it. I’ve got these hypothetical expenses covered in my budget, but I don’t see a need to inhibit my spending here with an envelope.

Dave says spend all the money you budgeted and if you don't, you've budgeted too much. I’m twisting this a bit. I’m going to try to spend as little as possible and split what is leftover at the end of the month. Half will go into savings and half will go toward my dream jar. This will be emergency shoe cash or maybe money to put towards furnishing my new place! We shall see. Either way, this is an opportunity to reward yourself for not spending everything you budgeted. But be sure to make adjustments to your budget if you continue to underspend (or overspend!).

So these are my systems! Dave Ramsey, the bill manager, and I are ready to take on the real world. What do you use to manage your expenses? I'd love to hear!

Wednesday, January 8, 2014

New Year, New Systems Part 1: Bills Bills Bills

Towards the end of last year, I decided that I needed new

systems for organizing bills, budgeting, and tracking the way I spend money. This was mostly driven by the need to pay for

grad school, the hopes of buying a home in Loudoun County,

AND the fact that I almost missed my credit card bill because it had fallen

under my night stand due to my sloppiness.

Not okay. So I spent a few months

Pinterest and Google searching, comparing this method to that method and

picking what I thought was right for me. Posting a novel about managing your finances probably isn't the best way to attract or retain readers, so I'll break it up into two posts; managing bills and managing expenses.

Does anyone else have bills flying around in their purse? Can’t remember if they have paid last month’s credit card bill? Ask what month is my car insurance due again? Or slack off at filing the bills you actually managed to pay on time? I have definitely been guilty of all of these things in the past.

This is what you need:

1. Bills to be paid: under this section, I’ve got a pocket folder with my current bills that have yet to be paid. Get them in the mail and send them straight to the binder until you have time/money to pay them! Do not stop at the stairs, night stand, purse, or dresser!

Part 1: Bills, Bills, Bills

Does anyone else have bills flying around in their purse? Can’t remember if they have paid last month’s credit card bill? Ask what month is my car insurance due again? Or slack off at filing the bills you actually managed to pay on time? I have definitely been guilty of all of these things in the past.

The second I found this idea on Pinterest, I was

in love. Turning something as boring,

tedious, and frustrating as bill managing into a cute and custom made system?

Done.

This is what you need:

1.5”-3”, 3 ring binder

1 or 2, 3-ring Pocket Folders

1 set of 5 Sheet Protector Dividers

Monthly Calendar

1 set of 12+ Dividers

I’ve got 5 sections, each designated by a sheet protector

divider;

1. Bills to be paid: under this section, I’ve got a pocket folder with my current bills that have yet to be paid. Get them in the mail and send them straight to the binder until you have time/money to pay them! Do not stop at the stairs, night stand, purse, or dresser!

2.

Schedule: Here I have a month at a glance

calendar for each month where I write the name of the bill on the date that it

actually needs to be paid. When I’ve paid that bill, I highlight it. I bought a cute Sugar Paper Calendar from Target but you can always print these off online for free. This is

my favorite section because I can visually see where I am and what’s coming

up. I also have a list of my bills paid

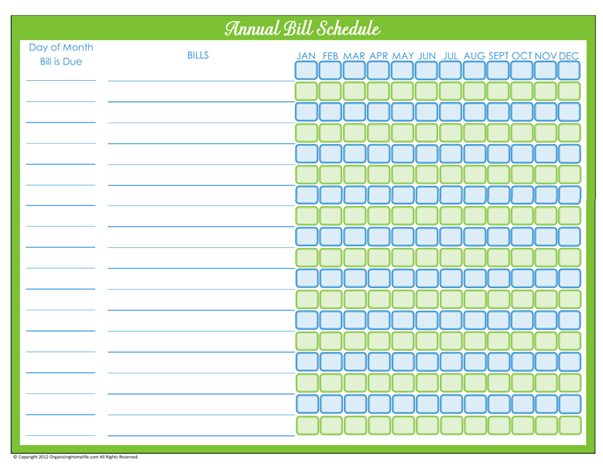

more than one time per year (picture to the left) next to a box indicating what month they need to be

paid in. Once you've paid the bill, check it off! This is helpful because you can

see the entire year at a glance. Print this form out here!

3.

Paid bills: Here I have the set of 12 dividers

but you may need more based on the number of bills you pay each month. Each divider is labeled by a type of bill or company. I have one for each of my credit cards, my

car payment, my insurance payments, tuition, etc. After I’ve paid the bill, I hole punch it place

it behind its designated divider in consecutive order.

4.

Budget management: This is where I keep a hard

copy of my monthly budget. Not a

necessity, but a helpful tool to keep alongside your bills.

5.

Other: This section is TBD. Right now my receipts and online purchases are here.

Some users like to keep all the bills in the binder for the

year and then file that entire binder away after the year is complete. I think I’ll wait until the binder fills up

and then file it away in my box as needed.

That is what is great about this system; you can customize and file

however you’d like! Not to mention, you

can pick it up and take it with you wherever you need to go! I was so excited about this that I even made my sister one, she is hooked!

Stay tuned for part 2: Managing my expenses!

Monday, January 6, 2014

Tackling 2014

What I’d like to tackle this year:

1. My Finances: Shocker, this is my number one. Doesn’t every 20-something-year-old try to achieve greatness in this department? Obviously this will be a challenge. But I’ve got Dave Ramsey on my side so hopefully we achieve a great year together. Stay tuned.

2. My GPA: 4.0 here I come! But realistically, I'll settle for a 3.5.

3. Preparation for the big move: That’s right, I said it. I’m getting ready to leave the nest, learn to fly, flee the coop, and any other crazy cliché used to describe this event. I want to do my research and cross t's so that if given the right opportunity, I'm ready to pursue it. Cross your fingers for me!

4. Run the Army Ten-Miler: What better year to set my goal than the 30th anniversary of the Army Ten-Miler! I've done a 10k so what's 3.8 more miles...? Luckily I've got until October.

What are your 2014 goals? I'd love to hear them!

1. My Finances: Shocker, this is my number one. Doesn’t every 20-something-year-old try to achieve greatness in this department? Obviously this will be a challenge. But I’ve got Dave Ramsey on my side so hopefully we achieve a great year together. Stay tuned.

2. My GPA: 4.0 here I come! But realistically, I'll settle for a 3.5.

3. Preparation for the big move: That’s right, I said it. I’m getting ready to leave the nest, learn to fly, flee the coop, and any other crazy cliché used to describe this event. I want to do my research and cross t's so that if given the right opportunity, I'm ready to pursue it. Cross your fingers for me!

4. Run the Army Ten-Miler: What better year to set my goal than the 30th anniversary of the Army Ten-Miler! I've done a 10k so what's 3.8 more miles...? Luckily I've got until October.

What are your 2014 goals? I'd love to hear them!

Sunday, January 5, 2014

2013 Wrap Up

I’ve been struggling to come up with a good first post. Lucky for me, the timing of starting this

blog worked out perfectly with the start of 2014! So here is my 2013 wrap-up:

1. Graduated college: Okay, so this was actually December, 2012. But it happened so fast that it was basically 2013. But I did it! Done! The day I thought would never come actually happened. I loved my time at JMU but was definitely to move forward come graduation day!

2. Move back home: Just throwing this out there up

front, I live at home in my childhood bedroom.

As excited as I am to one day move out to my own place, as an early

twenties gal, I know I’m never going to get to live like this again. It’s a crazy ride but I am happy to be at

home with my family. However, cleaning

my room is constantly popping up on my to-do list so

hopefully by my 2014 wrap-up I’ll have figured out how to fit everything I own

into one room at last (any suggestions?).

3. Big girl job: Check! Interesting fact-- #1-#3 all happened within

48 hours. What a whirlwind! I just passed my 1 year anniversary of life

in the real world. Though not anywhere

close to being an expert and tomorrow I’ll probably want to take back this

statement, II can safely say I’ve got my feet on the ground as of today.

4. Bought a new car: Wasn’t expecting this

one. Everything hybrid about my beloved

Honda Civic died in early January. I was

heartbroken. It took me a full 12 hours

to recover and pick out my new baby.

Luckily I got hooked up with a great post-grad program and bought

myself, wait for it…another Honda Civic!

Out with the old and in with the new.

5. Got my first credit card(s): To those of you who have been earning credit

for years, kudos to you!

6. Took the GRE: This was the last thing on my mind

when I walked across that stage in December.

Grad school? Me? Heck no! I’m

still not entirely sure why I decided to take this step whether it was to go

with the recent college grad flow or a desire to continue to learn. Either way, I’m glad it happened. I studied in bits and pieces all summer until

taking the test in October. So happy to

say this is done and (spoiler alert) it paid off!

7. Went to HAWAII: Literally the day after taking

the GRE I hopped on a plane with my mom, brother, sister, pregnant sister-in-law,

4-year-old-niece, 3-year-old nephew, 1-year-old niece and went to Hawaii to

visit my other brother! This was my

first time to Hawaii and our first family vacation in over 10 years! Such an amazing experience!

8. Got accepted to grad school: I did it! In November, 2013, I received my acceptance

letter to Marymount University’s MBA Program.

I am excited to start this

month! Call me a cliché but I’m even

more excited about buying school supplies again.

9. Ran my first 10k: Now this took some training and focus. I’ve been struggling since high school to

convince myself that I love to run. I’ve

run a couple 5ks and have done what was needed to stay in shape and eat those

beautiful desserts, but never really found joy in gasping for air and not being

able to walk. I signed up for a Thanksgiving

race thinking in theory, this was a terrific idea. What better way to start the biggest food day

of the year than with a run?? Wrong. I forgot how cold November could be. But anyways, I

downloaded a 10k training ap, got some new kicks and some fancy running

clothes, made some sweet playlists, and hit the pavement. My goal was to finish in under an hour and I

made it in 59:52 despite the 25 degree weather. Win. I’ve already

signed up for another 10k and I can’t wait!

10. Made it through the first year: For those of you who don’t know me all that

well (yet!), this year I lost my father.

It has definitely been a challenging one. I would not have

been able to do everything you’ve just read without him and I still continue to

learn so much from him every day.

I think it’s safe to say this has been a big year! I’m happy and sad to put it behind me but so

excited to move forward and see what 2014 has to offer!

Subscribe to:

Posts (Atom)